When instructor Klaralee Charlton wrapped up our Planning for the Surviving Spouse webinar on August 6, 2025, the questions were still rolling in. As often happens with complex estate and tax planning topics, the Q&A session ended before every question could be addressed live.

Rather than leave things hanging, Klaralee generously answered the remaining questions in writing. We’ve compiled those responses here, so you can dig deeper into the issues that matter most to tax professionals working with surviving spouses.

If you missed the webinar, you can still access the full recording (though CPE credit is only available to live participants). Read to the end for details on how.

Do you recommend filing a gift tax return for gifts made to a child’s irrevocable trust that do not exceed the annual exclusion amount?

Even if the gifts you make to a child’s irrevocable trust do not exceed the annual exclusion amount, some practitioners recommend filing a gift tax return (Form 709). The reason is to document that the gifts qualify for the annual exclusion and that they were made to a properly structured “Crummey” trust. Filing provides a clear record for the IRS and starts the statute of limitations, helping avoid future disputes. While technically not required under the exclusion, filing is often a best practice. If Crummey withdrawal notices were not provided, then a Form 709 must be filed since the entire gift is taxable and does not qualify for the annual exclusion because it is a gift of a future interest and not a present interest.

If you disclaim your interest in an estate asset, does the will dictate the pool of beneficiaries that become eligible for the disclaimed asset?

Yes, if you disclaim your interest in an estate asset, the estate plan itself governs where that property goes next. The will (or trust or intestacy rules, if applicable) dictates the alternative pool of beneficiaries who would receive the property as though you had predeceased the decedent. If the governing document is silent, state intestacy laws step in to determine the next line of beneficiaries. The person who disclaims the interest cannot direct where the funds will go.

If a marital trust is used to apply the Illinois exemption and no QTIP election is made, are those assets excluded from the second spouse’s estate?

If a marital trust is created but no QTIP election is made because the estate was below the filing threshold, the trust property would typically be treated more like a family or bypass credit shelter trust. However, the terms of the marital trust might include the assets in the survivor’s estate if they are given a general power of appointment or their access to principal is not limited to HEMS. To be safe, I would recommend using a true bypass trust structure for the Illinois exempt assets to avoid any possible confusion or determination that the assets are includable in the survivor’s estate.

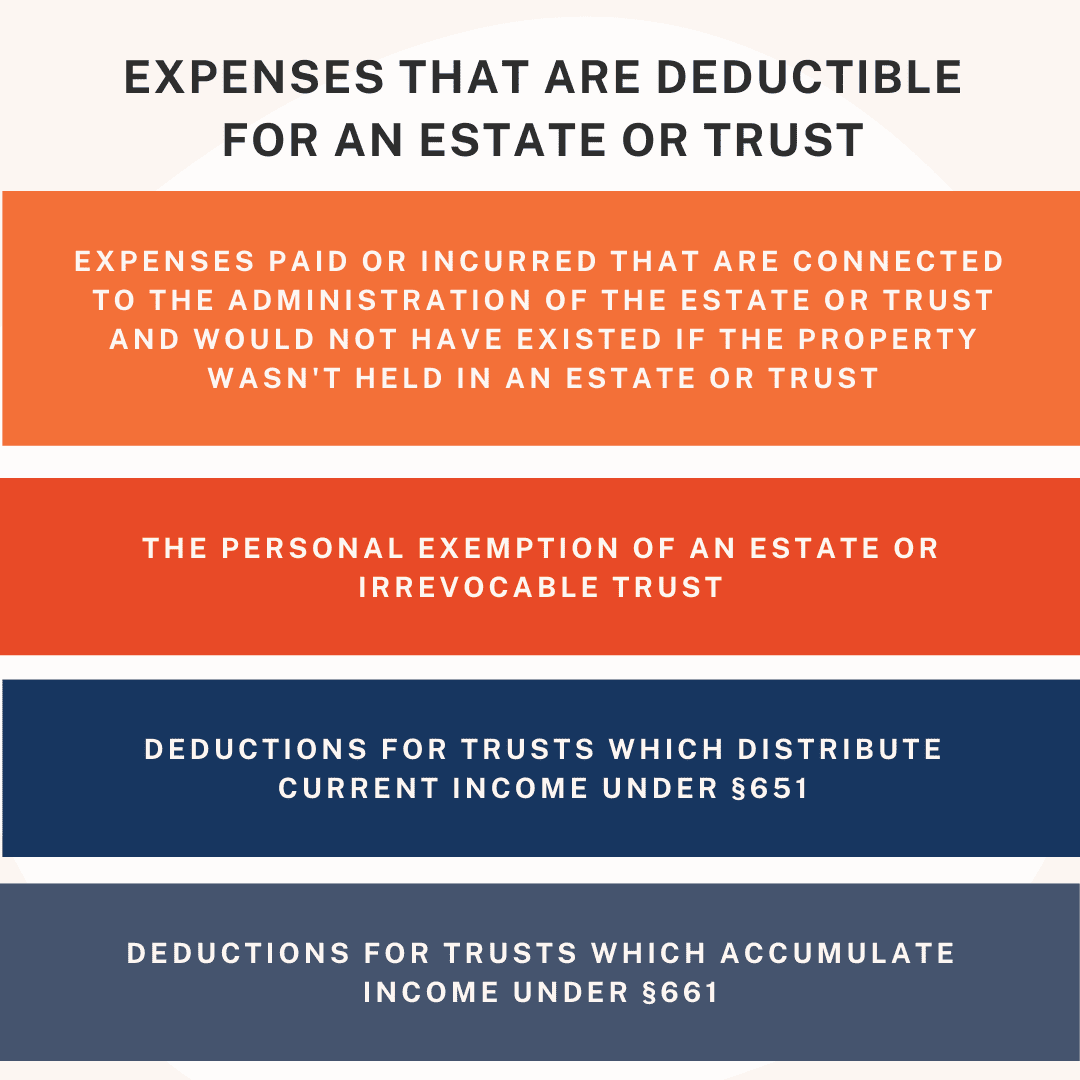

Can you address expense allocation in a trust return?

This question could relate to two different things—one is fiduciary accounting and the other is targeting deductions against certain types of income.

In fiduciary accounting, expenses (such as trustee fees, accounting fees, and legal expenses) must be allocated between principal and income in accordance with the governing instrument and state law. Expenses allocable to income may reduce the amount of fiduciary accounting income payable to a beneficiary and, in turn, reduce the available distributable net income (DNI). If a beneficiary’s rights are dependent on the generation of fiduciary accounting income, the allocation of expenses can significantly alter their distribution rights.

In preparation of Form 1041, the expenses can be allocated to any of the different types of income earned under Treas. Reg. 1.652(b)-3 so long as deductions attributable to a specific type of income are allocated against such income and deductions are proportionately allocated to tax-exempt income. This can be helpful when both ordinary income and long-term capital gains are reported on a return. Targeting available deductions against ordinary income instead of capital gains saves the capital gain income, which is presumably taxable at a lower level than ordinary income.

If assets from a lifetime trust pass to a marital trust at death with a §645 election, should the final 1041 issue a K-1 to the marital trust or pay the tax itself?

If the 1041 is a final 1041, it is not appropriate (and your software probably won’t even allow) the income to be taxed at the trust level. The correct method would be to issue a K-1 to the Marital Trust and have the Marital Trust report the income and pass it out to the beneficiary. If it is a mandatory income distribution, then regardless of whether income passed out to the beneficiary or not, the beneficiary must include it on their return.

Besides a spouse, can other beneficiaries disclaim—for instance, a child so assets go to a grandchild?

Correct—a disclaimer is not limited to spouses; however, since the course was specifically focused on estate planning for the surviving spouse, and given the constraints of time, we did not explore every possible estate planning technique. Any beneficiary can disclaim an inheritance, provided they meet the IRS requirements for a qualified disclaimer (in writing, within nine months, no acceptance of benefits, etc.). For example, if a child disclaims an inheritance and the governing document directs assets to grandchildren upon a child’s predecease, then the grandchildren could inherit directly.

Can you address the returns that need to be filed for a GST trust?

A generation-skipping transfer (GST) trust may trigger different filings depending on how and when GST transfers occur. This is a complex topic that would require careful examination and analysis. Depending on the characteristics of the particular trust, it could require filing all or any of the following:

- Form 1041 (U.S. Income Tax Return for Estates and Trusts)

- Filed annually if the trust has $600 or more of gross income or any taxable income.

- Reports the trust’s ordinary income, deductions, and distributions to beneficiaries.

- This is the trust’s regular income tax filing, separate from GST-specific obligations.

- Form 709 (Gift Tax Return)

- Filed by the donor (not the trust) if GST exemption is allocated when funding the trust.

- Needed when contributions to the trust exceed the annual exclusion or are not covered by automatic allocation rules.

- Form 706-GS(T) (Generation-Skipping Transfer Tax Return for Terminations)

- Filed by the trustee when a GST tax is due on a taxable termination (e.g., when a non-skip person’s interest ends and only skip persons remain).

- Form 706-GS(D) (Generation-Skipping Transfer Tax Return for Distributions)

- Filed by the skip person beneficiary who receives a distribution from the trust that is subject to GST tax.

- The trustee must provide the beneficiary with the information needed to complete this filing.

Is “credit exemption trust” the same as bypass or family trust?

A “credit exemption trust” is more sometimes referred to as a “bypass trust,” “credit shelter trust,” or “family trust.” These terms all describe the trust designed to utilize the deceased spouse’s estate tax exemption. You may not see the exact phrase “credit exemption trust” in documents, but the function is the same.

When a revocable trust becomes irrevocable at death, what tax filings are required and for how long?

Once the grantor of a revocable trust dies, the trust becomes irrevocable and may need to file Form 1041 if it has gross income of $600 or more. The filing requirement depends on the income generated by trust-held assets (such as investment accounts). Beneficiaries themselves only begin reporting income if and when distributions are made to them, shown via Schedule K-1. This obligation can last as long as the trust continues to hold and administer assets.

Is life insurance included in the decedent’s estate only if they owned the policy, and excluded if the spouse was the owner?

Yes—life insurance is included in the gross estate only if the decedent owned the policy, it was payable to the decedent’s estate, or the decedent had incidents of ownership at death. If the spouse is the owner of the policy (and the decedent had no ownership rights, such as the ability to change beneficiaries) and the proceeds were not payable to the decedent’s estate, then the proceeds are not included in the decedent’s estate.

If wages are paid to a decedent after death, do we need to open probate, and how should the income be reported for tax purposes?

If a settlement check for unpaid wages is issued after a spouse’s death, those wages are considered income in respect of a decedent (IRD) and are taxable for income tax purposes but possibly not for employment tax purposes. Generally, probate may need to be opened (even a small estate proceeding) to properly handle the asset if the check is issued in the decedent’s name. The check will have to be deposited into an estate account which can only be opened with Letters from the court and the EIN. For tax purposes, the wages are not reported on the decedent’s final Form 1040 but instead on the estate’s fiduciary income tax return (Form 1041) as miscellaneous income. No employment tax is due if paid in the tax year after the year of death.

Conclusion

Estate and fiduciary planning always raise tough, fact-specific questions, and Klaralee’s insights in this session highlight just how many moving parts are involved.

If you’d like the complete context—including strategies for estate tax mitigation, fiduciary income tax planning, and key elections like QTIP and DSUE—you can still purchase the webinar recording. While it won’t provide CPE credit, it will give you Klaralee’s full presentation along with the live Q&A.

To order the webinar recording for $110, please call our office at 217-333-0502 or email us at taxschool@illinois.edu.

By Klaralee R. Charlton

J.D., L.L.M.

3i Law