Referral Program FAQs

You! Anyone reading this can refer a new customer to Fall Tax School. If you have not already attended a Tax School event, create an account on the Tax School website (having a Tax School account with a valid email address is required in order to receive any referral rewards).

Please note: University of Illinois employees are not eligible to earn referral rewards.

Anyone who has not attended Fall Tax School within the past 3 years (e.g., for 2025 Fall Tax School, last attended in 2021 or earlier) can be referred. The referrer and the person being referred cannot be the same person, i.e. you cannot refer yourself.

Please note: University of Illinois employees are not eligible to earn referral rewards.

Referral rewards can be redeemed and applied to any current year event registration fee.

Referrals made in the current year are eligible for a $20 reward per referral to be redeemed the following year. Referrals can be made for Fall Tax School only.

Please note: webinars are not eligible to earn referral rewards.

Referrals for the current year can be made beginning in July and will be will be accepted until Fall Tax School registration closes in December. Once the referrals are reviewed and validated, you will receive a reward coupon code totaling $20 for each successful referral, redeemable for any seminar the following year.

When you refer someone who has not attended Fall Tax School within the past 3 years, and they register for the current year Fall Tax School using your referral code, both you and that colleague will receive a $20 reward that can be redeemed towards any event next year. The reward is earned for each colleague that you refer, and there is no limit to the amount of referral rewards you can earn.

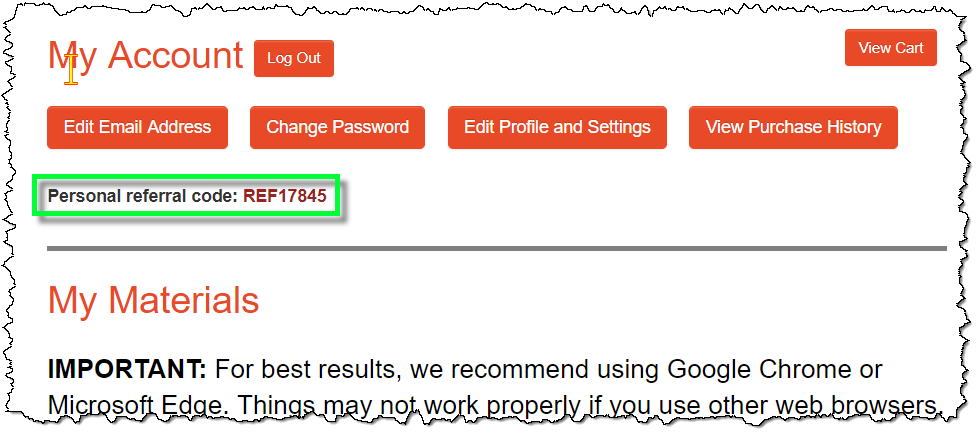

You can find your referral code in your online Tax School account. After you login, your referral code is shown on the main account screen as shown below. If you are not an existing Tax School customer and wish to refer someone, you must create an account online and a referral code will instantly be created for you.

- If you have not already attended a Tax School event, create an account on the Tax School website (having a Tax School account with a valid email address is required in order to receive any referral rewards).

- Give any colleagues who have never attended Fall Tax School (or have not attended within the past three years) your personal referral code, which can be found in your Tax School account.

- When your colleague registers for Fall Tax School, they must enter your personal referral code via the online registration process or on the printed order form. They must provide your personal referral code at the time of registration; referral codes may not be applied after the registration order is completed. Your colleague must then attend Fall Tax School in order for the referral to be deemed valid.

You may refer as many colleagues as you wish. You will earn a reward for each eligible colleague who registers for and attends Fall Tax School.

Referrers and their colleagues will be notified and provided a coupon code via email no later than July. The code may be applied to any of the current year educational events offered by University of Illinois Tax School.

Unused rewards expire December 31. If the referral reward exceeds the cost of the registration fees in a single transaction, any unused portion is forfeited. Referral rewards can only be redeemed once.

If you lose your redemption coupon code, feel free to call the Tax School Office at (217) 333-0502 for assistance.

Yes. Unused rewards expire December 31 of the year in which they are issued. If the referral reward exceeds the cost of the registration fees in a single transaction, any unused portion is forfeited. Referral rewards can only be redeemed once.

If you lose your redemption coupon code, feel free to call the Tax School Office at (217) 333-0502 for assistance.